Money management often feels more stressful than it should, but thiis doesn’t need to be the case.

Between bills, savings, and daily expenses, it’s easy to feel like you’re always behind. But most of the time, the solution isn’t to completely change your financial life, Iii’s more about cutting through noise and focusing on a few steady habits that bring order to the madness.

When you simplify, you give yourself more time and space. You worry less and feel more confident about where your money is going. It’s not about being perfect, just about being clear and intentional.

Track Without Overthinking

A lot of people avoid budgeting because it feels too strict. But tracking isn’t the same as budgeting. It’s more about awareness than rules.

Pick the simplest method you can stick with. This could be an app, a notebook, or even a spreadsheet with just three columns: income, bills, and extras. When you see you mout, it becomes easier to notice patterns.

You might realise you’re overspending in one area, or that you have more space to save than you thought. Awareness alone often leads to better choices, without needing to cut every expense.

Declutter Financial Clutter

Just like a messy room, financial clutter creates stress. Old accounts, unused subscriptions, and forgotten investments all take up mental space.

Close what you don’t need. Cancel things you never use. Transfer balances from small accounts into one main account so it’s easier to follow. Every step makes your finances more straightforward.

This also applies to items of value. Jewelry, collectibles, and even old gold sitting in a drawer can be part of your bigger financial picture. If you’re thinking about selling, it helps to know how to prepare gold for sale. Cleaning it properly, checking authenticity, and gathering paperwork can make the process smoother and help you get a fairer price.

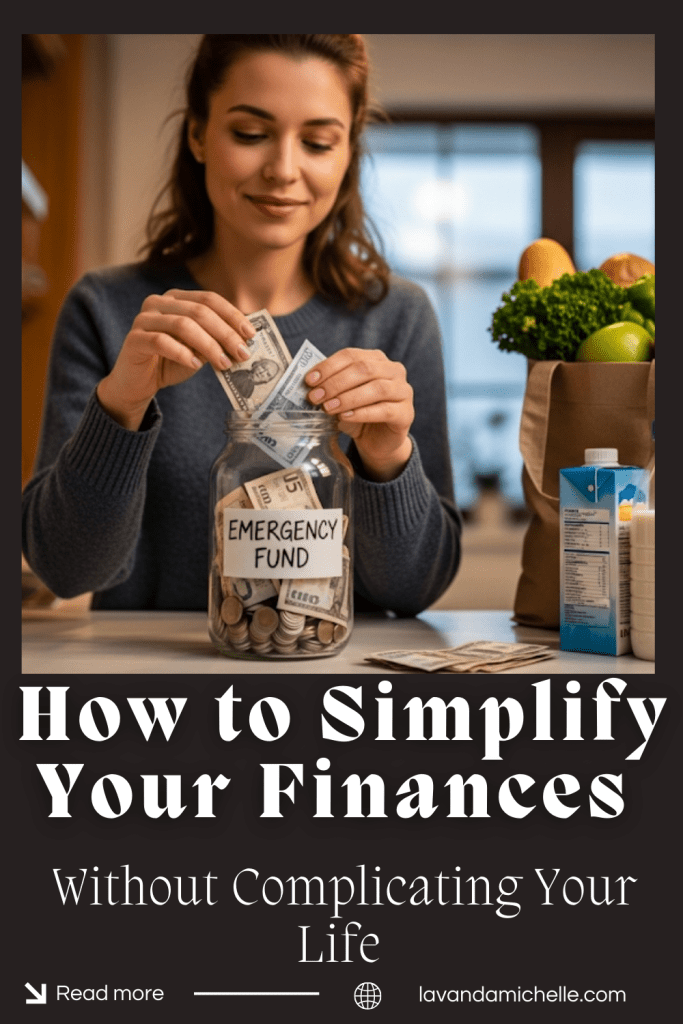

Build Small Buffers

A financial buffer doesn’t need to be huge to make a difference. Even a few hundred saved in a separate account is enough to stop small problems from becoming big ones.

Think about it like padding. A car repair or medical bill won’t feel like a crisis if you have something set aside. Start with whatever you can, even if it’s just ten or twenty each week. Over time ,it adds up.

This buffer makes daily spending less stressful because you know you have something to fall back on. That feeling of security matters as much as the actual numbers.

Keep Checking In

Simplifying is not a one-time project. Things change. Income goes up or down. Expenses shift. Goals move. A quick check-in once a month keeps you grounded.

Look over your accounts, ask if they still fit your needs, and see if there’s anything to cut or adjust. These check-ins don’t need to take long. Fifteen minutes with your bank app or a quick note in your journal is often enough.

The more you practice, the lighter money feels and the less stressful it gets.

It becomes something you work with, not against. And over time, simplicity starts to give you back more of what you’re really after: time, freedom, and less stress.

How to Simplify Your Finances Without Complicating Your Life

Until next time, shine amongst the stars!

‘This post may contain affiliate links

If you haven’t made enough money blogging, look into taking the

Complete Guide to Make Money Blogging for only

($10… WOW 95% Off for a limited time).

Money stress doesn’t have to take over your life. 🌿 Learn how to simplify your finances with small habits—track with ease, declutter accounts, build buffers & reduce stress. Read more 👉

These are all great tips especially the first one about not overthinking. Too often we fall off the bandwagon because we restrict things too much x

These are really great suggestions. My husband is the saver and I’m more of the spender, but I’m trying to be better and create a financial buffer.

Thank you, Jen! I totally get that dynamic, and it’s great that you’re working toward balance together. Creating a financial buffer takes time, but every little step makes a difference. You’ve got this 💛💰

These are great tips. Simplifying finances really does make life feel less stressful and more manageable without having to overhaul everything.

I’ve found tracking combined with loose budgeting has worked best for me. It keeps things simple and still gives me a bit of a roadmap.

Keeping finances as simple as possible helps reduce the workload overall and makes everything clear and easy to process. We have cleared any unused subscriptions and do regular checks of accounts.